Relative Strength Index (RSI)

This is called the relative strength index.

This analyzes the extent of the rise/fall in the market price volatility,

If the current market price is rising, how strong is the upward trend?

Or the current market price is declining, how strongly a downward trend?

So this is a momentum indicator that shows how strong using a percentage(%)

It is an index introduced by Wilder in 1978 in the introduction to technical analysis.

The formula is as follows.

Average (sum of rise in n days) / [Average (sum of rise in days) + Average (sum of fall in n days) * 100

Usually, n is 14 days. If this index is less than 30, it is regarded as over-selling. If it is over 70, it is regarded as over-buying

Samsung Electronics weekly chart.

When the RSI is below 30,

October 2014, August 2015 and February 2016, respectively.

At that time, the buyer turned to an upward trend for a few weeks or a few months.

On the other hand, in the case of 80 or more,

In March 2015, the sell signal was turned on and turned downward

In September 2016, it was flat, but now the stock price has broken the peak.

However, it can be seen that it is an index that is quite right to fit.

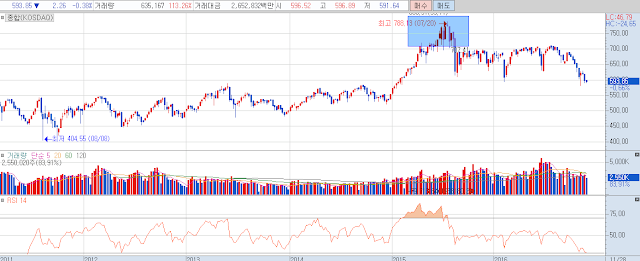

POSCO monthly chart.

There were four times when RSI fell below 30.

In 2008 and 2016, the trend has shifted since then

The 2011 and 2013 years were not able to turn around and they fell back again.

What's the difference?

The difference is fundamentals.

In 2008 and 2016, earnings improved. In 2008, we overcame the financial crisis. In fact, most of the stocks, not just POSCO, had a RSI of less than 30, and all of the stocks have risen. The quantitative easing of the US and China has boosted the economy.

As iron ore prices soared in 2016, POSCO's earnings improved.

However, restructuring effects of subsidiaries were greater than iron ore prices.

The 2011 and 2013 years were worse than expected.

It was an oversold section, but it gets worse without a change in fundamentals.

What we can see here is

In the absence of significant fundamental changes, RSI is highly likely to pick up selling / buying points in consideration of oversold / oversold.

However, if there is a big change in the fundamental, buy / sell should not be done even if overbought / overbought.

How should this be checked?

I assure you, an analyst report is enough.

What we need to understand is not a small fundamental change in the month and quarter.

You only need to check if there is a structural problem / structural good.

If there is only a small problem / tolerance that is not a structural problem, it would be quite high hit ratio if you check the oversold / oversold with RSI and get a sell / buy point.

What if I can not check my fundamental?

In that case, you can check indirectly if you use other supporting indicators.

Any change will appear on the supply or price side and use an auxiliary indicator to check for it.

What are the indexes that are difficult to analyze fundamentals?

Indexes are difficult to analyze by qualitative analysis. Because it represents an economy.

If you use the RSI index, you can easily see the recent small / mid cap and KOSDAQ highs.

The KOSDAQ index.

In the mid-2015, KOSDAQ index was over 700, RSI continued to give oversold warnings.

This is a KOSPI mid-cap index.

Likewise, overtime signals were coming out last summer.

#RSI, #Relative Strength Index,

작성자가 댓글을 삭제했습니다.

답글삭제